Thomas Metals Sourcing Site

Company: Xometry (Thomasnet.com)

Project Date: 2023

Role: Senior UX designer responsible for discovery research, product design, and UX/UI design

Team: VP of Product, Engineering Lead, Research Lead

Challenge

Create a new B2B website for small-medium business buyers to source and quote with metal suppliers in order to generate more leads for Thomasnet.com subscribers.

What We Did

Conducted discovery research interviews with new user sector

Identified user behaviors and pain points

Reimagined the user journey and designed a shorter flow

Designed a targeted landing page and request for quote (RFQ) feature for buyers

Results

Eliminated a major sourcing pain point for SMB buyers

Designed, built, and launched website in 3 months

Doubled conversion rate and increased quote rate during trial run

Project Overview

Thomasnet.com is a lead generation platform for B2B industrial suppliers. Its corporate buyer user base shrank in recent years, resulting in fewer leads for suppliers. Thomas wanted to expand its buyer audience by attracting buyers from small-medium size businesses, who sourced differently.

The product team had to create a microsite focused on the needs of SMB in the metals product category. After conducting discovery research, I designed a specialized landing page and dynamic form to help potential buyers request quotes from metals suppliers. Early trials showed that we were successful in increasing audience reach and conversion rates, therefore potentially increasing ROI on marketing dollars spent by suppliers.

Challenge

Context: Finding More Leads for Thomas Suppliers

B2B industrial suppliers pay to be listed on Thomasnet.com’s supplier directory with the expectation of gaining exposure to in-market buyers and generating sales leads. Historically, Thomas buyers were individuals from large corporations doing strategic sourcing. Over the past year, the quality and quantity of leads have decreased, resulting in subscriber churn. Many factors contributed to this decline, including supply chain challenges after the pandemic and the rise in B2B ecommerce for industry.

Objective

Thomas saw an opportunity to diversify and grow its user base by focusing on previously overlooked small-medium business buyers. We hoped to expand the sales funnel for suppliers by catering to a user sector who primarily purchased supplies “ad-hoc” or project-by-project.

To test this hypothesis, the product team was tasked with developing a microsite for small-medium business buyers in one product category: metals. The site had to attract in-market buyers, support their procurement journey, and ultimately convert them into leads for Thomas’ metals suppliers.

Metrics

We tracked page views, conversions, and quotes from suppliers to compare them against those of the main site in the same product categories. We defined a conversion as a buyer submitting a request for quote (RFQ) to suppliers, which turns them into a lead. Quotes from suppliers were replies to RFQs with pricing information.

Understanding the “Ad-hoc” Buyer

Discovery User Research

This type of B2B buyer has not been studied previously at Thomas. Before designing a new product, I conducted generative research in order to learn about their sourcing habits, pain points, and needs. I planned and executed user interviews with 8 Thomas and non-Thomas buyers who purchased commodity metals for their business. After analyzing the interviews, I created a user persona and documented insights on their behaviors and pain points.

Photo credit: Umit Yildirim, Unsplash

User Persona

User Statement: Omer owns a business that makes machinery components. His projects vary each quarter and he orders materials for one job at a time. He is looking for a reliable supplier closer to the shop in order to save on shipping costs.

Role: Owner, manager, or procurer of a small to medium size fabrication business

Responsibilities: Handles supplier sourcing, decision making, and/or purchasing of materials for the operation of the business. Might wear many hats in their role and is stretched for time.

Primary Goal: To purchase materials for specific projects, have them delivered on time, and keep costs reasonable. Not looking for a long-term strategic partnership with suppliers.

Supplier Criteria: Not too picky about suppliers as long as their products fit technical criteria and budget. Prefers local suppliers to save on shipping costs.

When They Source: Only searches for a new supplier when they encounter issues with existing suppliers (e.g. product availability, delivery times, pricing, quality, etc). Otherwise, prefers to stick with suppliers they have happily worked with in the past.

User Behaviors

Compared to Thomas’s primary strategic sourcing audience, ad-hoc buyers source at a smaller scale and on a faster timeline.

An ad-hoc buyer typically:

Starts the sourcing journey with a product focused search on a search engine

Is open to using ecommerce if he/she cannot find a local supplier

Is not looking for custom fabricated products

Purchases smaller volumes of materials on a project-by-project basis

Has a shorter buying cycle. He/she wants to get pricing and buy quickly, and does not benefit from extended supplier evaluation and negotiation.

Pain Points

When sourcing metals, ad-hoc buyers encounter friction such as:

It is tedious to research and evaluate local suppliers, who may not have a big web presence or product catalog. Thomas’s supplier directory presents an overwhelming number of options.

It is time-consuming to communicate with multiple suppliers about pricing, product availability, and logistics.

It is frustrating to be ignored by suppliers after initiating contact.

It is complicated to manage cash flow in a small business when paying for materials upfront.

Shortening the Path to a Conversion

Ad-hoc buyers purchase on a faster timeline than strategic sourcing buyers and their biggest pain points involve supplier research and communication. Given that these buyers valued product criteria over supplier criteria, we designed a flow that eliminates supplier search and evaluation before requesting a quote. Instead, Thomas would match buyers with multiple qualified, trusted suppliers based on the products they are seeking. The marketing and sales team enrolled suppliers in this “quick quote” network.

User flows to request a quote and receive one

Designing a Targeted Landing Page

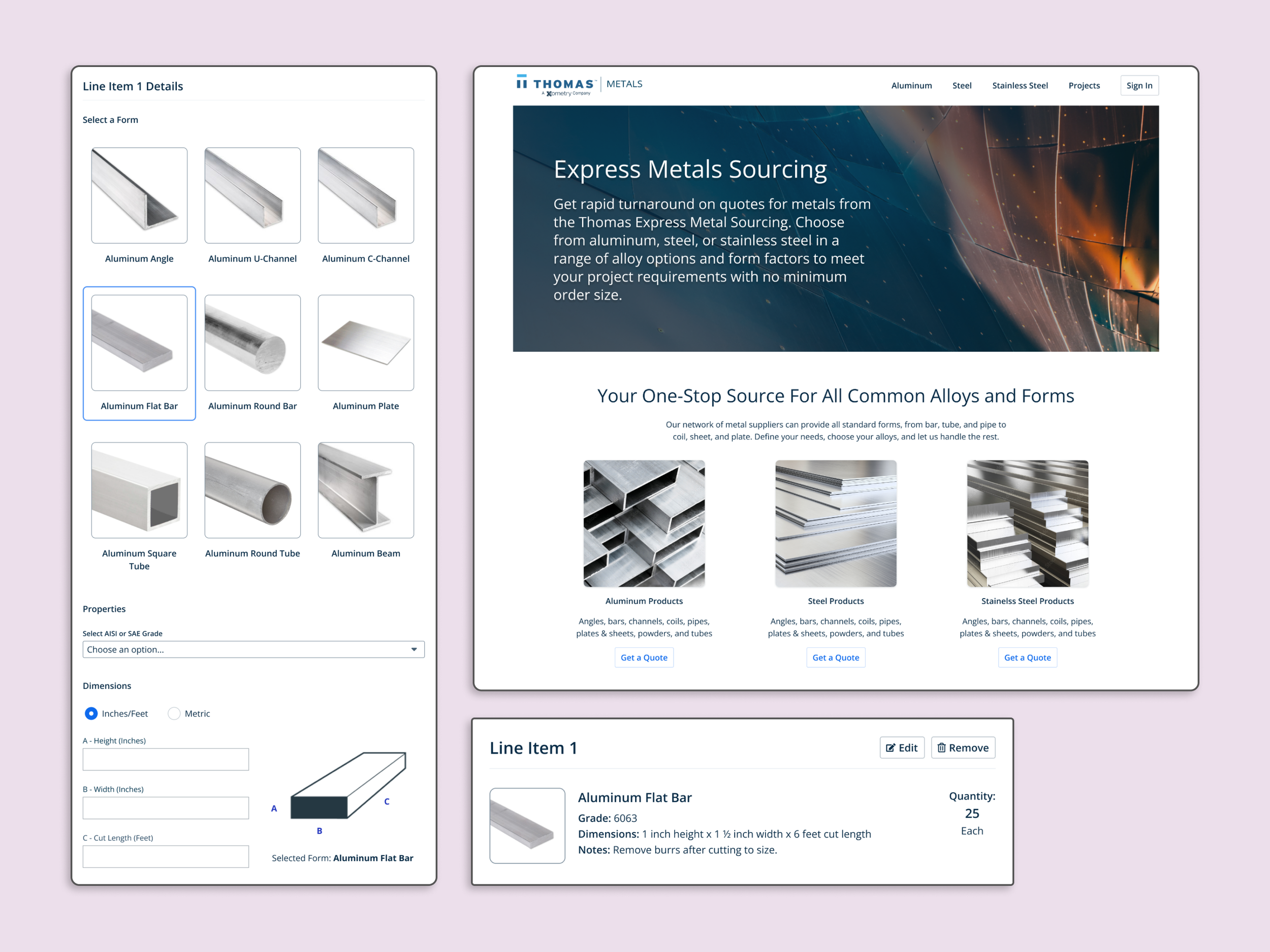

Since ad-hoc buyers typically start their sourcing journey on a search engine instead of on Thomasnet.com’s supplier directory, I designed a SEO-friendly landing page that is specific to their product query (e.g. buying aluminum) and outlines value propositions that address pain points unique to the ad-hoc buyer demographic. I worked with a technical copywriter to include product category keywords and a UX copywriter to shape the value props. We aimed to boost conversions by omitting a login wall and limiting the actions users can take. For example, there is only one CTA, ‘Get a Quote’.

Landing page for aluminum

Sketch of landing page

Helping Buyers Build Organized, Actionable RFQs

A complaint we frequently received from suppliers was that the inquiries they receive from buyers do not contain enough information to form a quote and they need to message back and forth with the potential customer, which could take several days. After getting more details, they might learn that a buyer is seeking items that they do not sell.

The generic request for quote (RFQ) form on the main site does not have instructions on how much detail to include, so buyers tend to be brief. We needed a form that supports the full material specing and quoting experience.

Before: Using this form, potential buyers sent requests without enough information to quote

I designed a dynamic form that lets users spec and itemize products they would like to quote. I wanted to create an “add to cart”-like experience for buyers who were used to shopping online for materials.

After working out the design in low fidelity, I created high fidelity mocks using our design system. When I did usability tests, I found a higher rate of task completion when item specification came before contact info input.

We hypothesized that the detailed, organized quote requests would generate more valuable and actionable leads for suppliers, resulting in a higher quote rate. The structured data input also allows Thomas staff (and later AI) to match them with qualified suppliers.

Dynamic form for adding specs, high-fidelity

Dynamic form for adding specs, low-fidelity

Itemized RFQ form, high-fidelity

Itemized RFQ form, low-fidelity

Impact

Redesigning a more direct path to conversion reduced the number of steps to request a quote from 7 to 4. By allowing Thomas to take over the most time consuming aspects of the user journey, researching and communicating with suppliers, we eliminated a major pain point for ad-hoc buyers who wished to quickly get quotes from multiple local suppliers.

RFQ submission success screen

On the microsite, the user flow is shorter while delivering better results.

After a 4-week trial launch of the metals microsite, priorities have shifted in the company and this project was abandoned. Therefore, we were unable to iterate on the product or measure its longer term impact on supplier retention. It is also not possible to assume how engagement would hold up over time.

During the limited trial period:

The targeted landing pages captured an additional 34K page views from search engines, increasing the size of the sales funnel for metals suppliers.

The conversion rate of the metals microsite (RFQ submissions/page views) was 1% compared to .43% on the main site. This means that suppliers could expect additional leads coming in from a new user sector and a higher ROI for their subscription.

The quote rate (pricing quotes from suppliers/RFQ submissions) was 41% for the metals microsite compared to just 1.8% on the main site, suggesting that a specialized experience generated higher quality leads.

Additionally, our team gained valuable insight on a previously underserved user sector and had the opportunity to reimagine a core service for an important supplier category.